Green Bonds Review 1Q22: The green & sustainable bond market starts to mature

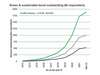

Green & sustainable (G&S) bonds issuance has been on an exponential upward trajectory, rising by an average of 70% annually over the five years to 2021. Yet in the first quarter of 2022 issuance volume dropped by 18% year-on-year, the first significant annual decline in the segment’s history. Does this signal the end of the segment’s rapid growth? And what else can the first quarter of 2022 tell us about the future of this fast-evolving market?

Still growing despite cyclical slowdown

The double-digit drop in supply in G&S bonds, while notable as the first of its kind, tracks the overall decline in the primary bond market in the first quarter. It shows that the G&S market is not immune to the factors – from central bank normalization to the war in Ukraine – that impacted bond markets as a whole. Furthermore, the total value of outstanding G&S bonds continued to rise over the quarter, reaching almost 1.9 trillion euros at the end of March, 10% higher than three months earlier.

The volume outlook looks much more positive, notably for sovereign issuers in the eurozone, with Austria, Netherlands, Belgium and France all expected to tap the market in the quarters ahead.

Source: Bloomberg, Natixis

Broadening and differentiating

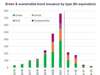

The rapid expansion of the G&S bond market has been accompanied by a broadening in formats. While in 2016-2018 classic green bonds – meaning those issued to finance a specific green project – accounted for 80 to 90% of the market, the proportion was 32% only in the first quarter of 2022. The rest of the market today is made up of social bonds (dedicated purpose for projects with a positive social impact), sustainability bonds (dedicated purpose for either green or social purposes) and sustainability-linked bonds (general purpose, with coupons linked to specific sustainability linked KPIs).

This latter format, which scarcely existed three years ago, continues to grow strongly, almost tripling in the first three months of 2022 compared to the same period in 2021. Sustainability bonds also continue to increase their market share to 17% of the total versus 14% in the first quarter the previous year.

Source: Bloomberg, Natixis

Pricing reflecting investors’ growing options

Another indicator of the market’s growing maturity is the reduction in the premium investors are willing to pay for a G&S bond versus a comparable conventional bond, the so called “greenium”. This continued to erode for G&S bonds issued by sovereign entities over the first three months of 2022, with a widening of bid-offer spreads for G&S bonds and green bonds underperforming standard bonds, largely as a result of the shear growth in volume of issuances by European governments. For A-rated corporate debt, meanwhile, G&S formats continue to command a pricing premium in primary markets, a trend that become more pronounced in the first quarter of 2022.

Overall, the first quarter of 2022 indicated a growing maturity of the G&S bond market, with volumes largely moving in line with the overall market, pricing reflecting supply-and demand dynamics, and the market continuing to diversify in terms of formats.

Discover the full first quarter 2022 Green Bonds Review report

Watch the Green Bond Review by Natixis CIB held on June 28