Trade Winds: How Trump's Policies Are Reshaping Emerging Markets Across the Globe

As the global economy continues to grapple with the potential implications of President Trump's trade policies, emerging markets across the Americas, CEEMEA (Central and Eastern Europe, the Middle East, and Africa), and Asia are experiencing varied impacts.

Benito Berber, Chief Economist for the Americas, Trinh Nguyen, Emerging Asia Economist, and Inna Mufteeva, CEEMEA Economist, take a look into the possible effects of these policies, highlighting the winners and losers in each region while providing insights into the broader economic landscape.

The Americas: Tariffs and Trade Dynamics

The most affected countries in the Americas are Mexico (and to a lesser extent Colombia), which is closely integrated into US supply chains, particularly in the automotive industry. The imposition of tariffs, especially the 25% on autos, poses a significant threat to Mexico, which relies heavily on manufacturing exports to the US. The potential for retaliation from Mexico could further complicate the trade relationship, leading to a cycle of escalating tariffs that could hurt both economies. However, while we expect the USMCA to be renegotiated,

Mexico is likely to see very low tariffs, closer to 0% than 25%. This is because many US companies operate in Mexico, so high tariffs would impact US manufacturing and supply chains - exactly what Trump is trying to avoid.

Argentina's more closed economy provides a buffer against US tariffs, allowing it to remain somewhat insulated from the immediate impact of Trumponomics. In addition, President Milei, who is aligned with President Trump, may receive support from the US administration to negotiate a new IMF program. However, commodity-dependent countries such as Brazil, Chile and Peru could face challenges as global commodity prices could fall on fears of reduced global demand as a result of a trade war.

CEEMEA: A Mixed Bag

The impact of US tariffs is less pronounced in the CEEMEA region compared to the Americas and Asia. Countries like Hungary and South Africa are more exposed to the US market, with South Africa being particularly vulnerable due to its slightly higher exports to the US (around 8% of the country’s total exports) and reliance on commodities. The potential for reciprocal tariffs could exacerbate the situation, leading to a decline in trade volumes and economic growth.

Central European countries and, notably,

Hungary face sectoral risks, primarily in the auto industry, which depends largely on German car makers. The country's strong ties to Germany mean that any disruptions in the auto supply chain could have severe consequences for the region’s economy. However, Poland's more diversified export base provides a buffer against the impacts of US tariffs, allowing it to weather the storm more effectively than its neighbors.

Turkey and Saudi Arabia also appear to be less affected by the trade tensions, due to only limited exposure to the US in exports (with a slight bilateral trade deficit) and low tariffs differential. Meanwhile, Saudi Arabia's close relationship with the US may shield it from some of the adverse effects of the trade war, although fluctuations in oil prices remain a concern for its economy.

EM Asia: Winners and Losers in the Trade War

In EM Asia, the landscape is significantly shaped by the ongoing trade war between the US and China. Countries like Vietnam, Malaysia, Thailand, and Singapore stand to benefit from the reshuffling of supply chains as companies seek to mitigate the impact of tariffs on Chinese goods. Vietnam, in particular, has emerged as a major beneficiary, capturing a larger share of US imports across various product categories, including electronics and textiles.

For now, only China has been targeted by implemented tariffs, but the looming threat of tariffs chips and pharmaceuticals poses a significant risk to Malaysia and Singapore, which have substantial exports in these sectors. The potential for a 25% tariff on chips could derail Malaysia's ambitions to attract foreign direct investment (FDI) in the semiconductor industry, a key area for its economic growth.

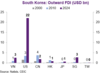

South Korea, while initially benefiting from exemptions on steel and aluminum tariffs, faces challenges as the US threatens to impose additional tariffs on autos as it has the highest exposure to US auto markets in the region. Given on-going stress, we expect South Korea to continue to support via monetary easing and front-loading of fiscal spending. The longer-term impact is likely higher FDI outflows to the US, which is already significant. While this helps Korean firms mitigate tariff costs, it has a negative impact on the Korean won as it puts downward pressure as future export

earnings go down as well as FDI outflow. Long-term job-losses are also likely to be significant even if firm-level mitigation efforts are possible. In ASEAN, Thailand and Vietnam are most vulnerable, but by a very small margin in comparison to Korea while Singapore and the Philippines are most immune.

The interconnectedness of the region's economies means that any downturn in China could have cascading effects on its neighbors, particularly Indonesia, which relies heavily on commodity exports to China.

Navigating Uncertainty

As emerging markets navigate the complexities of Trumponomics, the outlook remains uncertain. In this evolving landscape, policymakers must remain vigilant and adaptable, seeking to mitigate the impacts of trade tensions while capitalizing on emerging opportunities. The interconnectedness of the global economy means that the actions taken by one country can have far-reaching consequences, underscoring the need for collaborative approaches to trade and investment in the face of uncertainty.