In the latest edition of the Natixis CIB Monthly preview, Cyril Regnat – Head of Markets research, Christopher Hodge – Chief US Economist, Emilie Tetard – Cross-Asset Strategist, and Théophile Legrand – Rates strategist, discussed the intricate dynamics shaping the global economy, with a deep dive on the events impacting the US economy and broader implications for global markets, including shifting investor sentiment.

Cyril Regnat

Christopher Hodge

Emilie Tetard

Théophile Legrand

The U.S. Economy - Navigating a Complex Landscape

The labor market shows signs of underlying weakness, although it has not yet escalated into alarming territory. The three-month average payroll gains are steady at c.135,000, which aligns with overall population growth, indicating no immediate severe concerns. However, the unemployment rate has edged up slightly to a rounded figure of 4.2%, reflecting a minor increase in joblessness. Additionally, hiring rates are notably low, suggesting that businesses are hesitant to expand their workforce amid ongoing economic uncertainty.

This trend of cautious hiring is expected to continue, leading to a steady erosion in labor market strength over the next few months as uncertainty surrounding economic policies persists.

On the inflation front, recent data has been relatively benign, indicating that the primary impacts of tariffs on consumer and wholesale prices have not yet overwhelmed price levels. However, it is still too soon to declare victory over inflation. There was a significant "front running" of imports and inventory restocking that occurred in the first quarter and into the second, which may lead to cost pressures when businesses deplete their current inventories over the next few months and have to restock at higher prices.

Given the tight margins for retailers, additional price pressures are expected to emerge late in the summer. As such, the Federal Reserve is expected to remain cautious, likely waiting until it reaches the peak of tariff-induced inflation before implementing further monetary accommodation. Projections suggest that the Fed will be comfortable initiating rate cuts at its meetings in October and December, continuing the cycle of cuts into the first half of 2026.

Amid these economic indicators, the future of tariff policies remains uncertain. The expiration of the pause on “liberation day” tariffs is approaching on July 9th, a key date that could significantly impact the economic landscape. We anticipate that even if the tariffs do not return to the originally announced levels, they are likely to remain higher than in 2024, which could continue to weigh on economic performance.

Regarding trade relations, particularly with China—an essential trading partner for the U.S.—there is skepticism about the likelihood of establishing broad, sustainable trade agreements. Instead, a "trade truce" is anticipated, indicating a potential easing of hostilities but not a comprehensive resolution.

In the legislative arena, discussions are ongoing in the Senate regarding a proposed tax bill, with the House version already passed. A significant focus has been on Section 899, which proposes retaliatory taxes on entities from jurisdictions that impose what are deemed "unfair taxes" on U.S. companies. This would predominantly affect countries including but not limited to the EU, Canada, the UK, Switzerland, and Japan, while it is noteworthy that China does not appear to fall under these provisions.

The scope of these taxes remains ambiguous, particularly concerning foreign holdings of U.S. bonds. Initial insights suggest that the intention is to target corporate profits rather than portfolio flows, and there is a possibility that the actual implementation of these taxes, originally set for 2026, may be pushed back to 2027.

As this situation evolves, there is cautious optimism that the final version of the bill may be diluted or postponed, allowing for further negotiations and adjustments before any formal implementation.

Shifting Dynamics in Global Bond Markets

In recent weeks, the U.S. bond market has seen the yield on the 10-year Treasury hovering around 4.4%, while the 10-year Bund yield in Europe is at approximately 2.5%. The market remains focused on uncertainties surrounding U.S. tariffs and the potential for easing in Trade policy. The slowdown in the labor market has not reached a level that would prompt the Federal Reserve to confidently resume a rate-cutting cycle.

Notably, there has been a trend of non-resident investors slowly disengaging from U.S. assets, with some shifting their focus towards European assets, specifically government bonds. This reflects a relative underperformance of U.S. assets, as demand for higher yields on U.S. debt increases. In contrast, German bonds have outperformed, even as the anticipated increases in German bond supply could make them less attractive over time.

This shift indicates a broader trend of non-resident investors favoring European public debt, suggesting a growing attractiveness of these markets.

Yield Curve and Sovereign Spread Developments

The yield curve has displayed a steepening trend, particularly in the 10-30 year segment, while the long end of the curve has been impacted by volatility in rates, and uncertainties related to Dutch pension fund reforms - which are very active on the long end of the curve - affecting long-term bond demand. Expectations are that a new reform could reduce the necessity for long-term bonds, contributing to a more pronounced steepening in longer maturities.

In terms of sovereign spreads, the 10-year BTP spread (Italy’s government bond) is currently at its tightest level since 2021, trading at 90 basis points (bps). This narrowing is attributed to improved political stability in Italy and favorable economic growth outlooks for Southern European countries.

Conversely, there are upcoming risks in France, particularly as President Macron will have the opportunity to call a snap election and dissolve the National Assembly as early as July, and negotiations for next year’s budget will begin in September, which could lead to increased volatility in the OAT (French government bond) market.

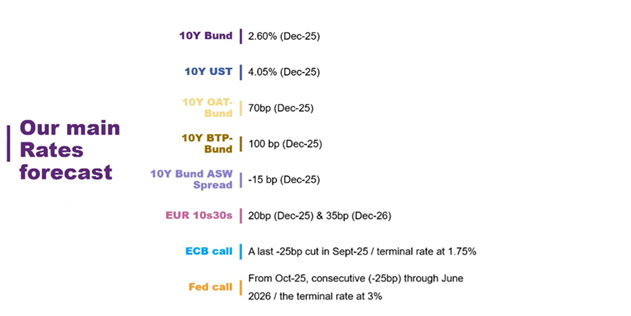

We expect the 10-year U.S. Treasury yield will trend lower by the end of the summer due to expected rate cuts by the Fed, with the possibility of initiating a rate-cutting cycle in October. The target for the Bund yield is projected to be around 2.6% by year-end.

The forecasts for sovereign spreads include estimates of around 70 bps for OATs and 100 bps for BTPs, with room for potential tightening. There is also potential for further steepening in the Euro curve, particularly in the 10- to 30-year segments, with expectations of 20 bps by the end of this year and 35 bps by the end of next year.

Lastly, the European Central Bank (ECB) is expected to make one final rate cut of 25 basis points in September before the current cycle concludes.

Navigating Market Turbulence

After the tariffs shock, risk appetite is back. The TACO trade (the prevailing belief is that Trump may ultimately refrain from implementing the aggressive measures he has threatened) has contributed to this bullish outlook. Additionally, the recent newsflow (especially on the inflation front, with lower than expected ) appears to validate the continuation of the Fed cutting cycle, which is another market stabilization force.

In the wake of these developments, the S&P 500 has experienced one of its most rapid rebounds, rallying over 20% since mid-April. Since the start of the year, European markets and emerging economies, have also shown robust performance, strongly outperforming US indices.

However, we hold a cautious short-term outlook, as there are numerous vulnerabilities ahead, including potential tariffs and geopolitical tensions that could influence market stability. Our economists suggest that macroeconomic conditions might soon shift due to delayed impacts of tariffs and inventory adjustments.

Looking further ahead, high valuations remain in the U.S. equity markets, with the S&P 500 PE near historical highs. This could limit potential expansion and cap the medium to long term performance. In contrast, European markets currently offer more attractive valuations and have the potential to outperform, aided by fiscal boosts, especially in Germany, and narrowing GDP gaps between the U.S. and Europe.

While historically, U.S. companies have demonstrated exceptional margins and earnings, there are indications that this "American exceptionalism" may be reaching its limits. Historical performance has shown that equity valuations tend to revert to their mean over time, suggesting a potential for U.S. equities to face headwinds in the future.

Additionally, there is a growing potential for portfolio reallocation flows from the U.S. to other markets, as American investors, who are heavily invested domestically, may seek diversification. Conversely, European and other international investors have capitalized on U.S. market opportunities, leading to an imbalance in investment flows that may need correction.

Thus, Natixis CIB’s view is very conservative for equities. The current environment still favors alternative strategies and geographical diversification, as trends may signal a normalization phase in investment patterns. As always, vigilance and adaptability will be key to navigating the complexities of the market in the months ahead.